Understanding Your Replacement Cost:

Here’s a statistic that may surprise you: over half of homes in the US are underinsured*. This is largely because home insurance policies are often believed to provide coverage based on a home’s market value, as opposed to its replacement cost. Understanding the difference between these two concepts is a key factor in making sure your coverage is adequate for the high standards of your home.

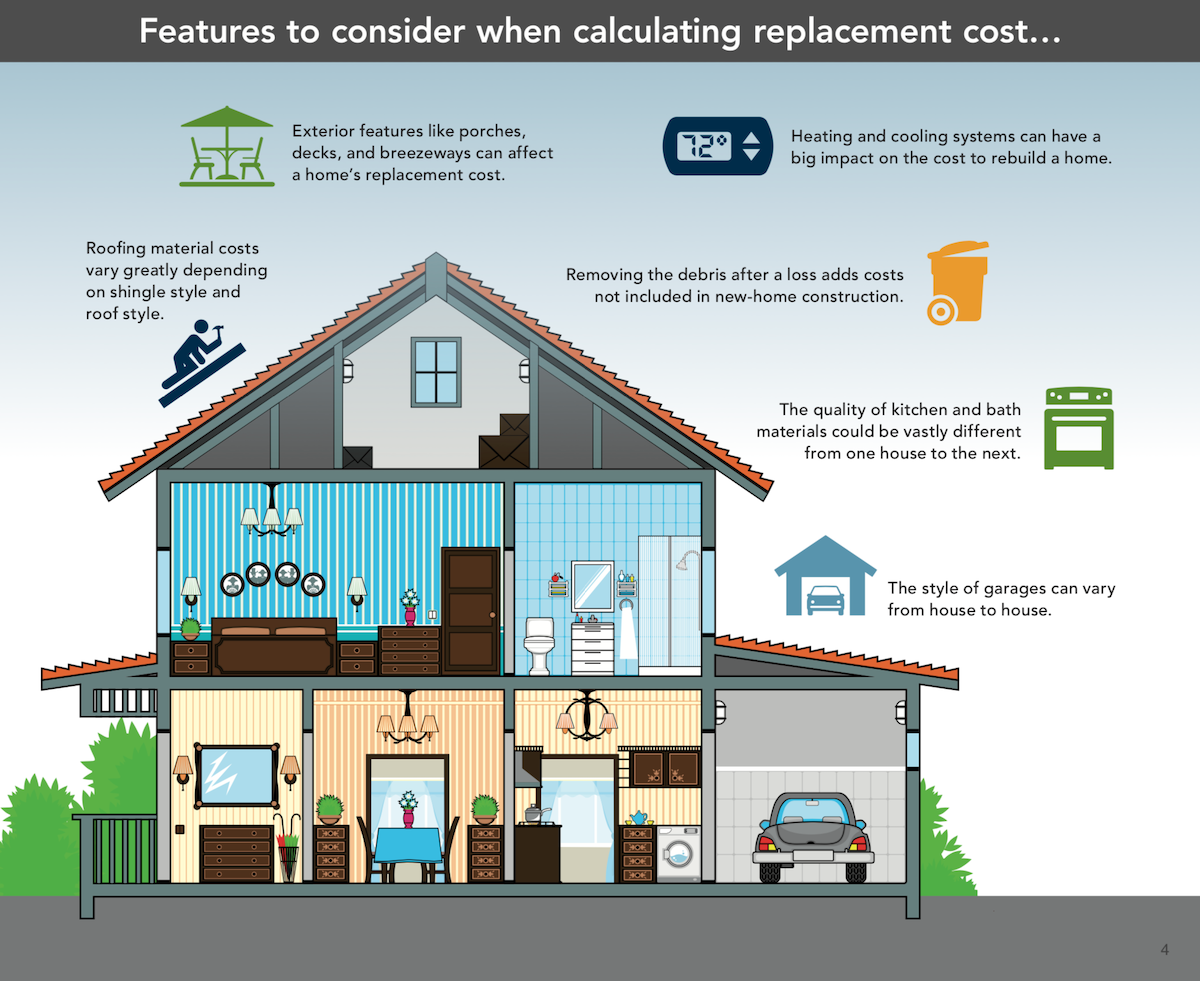

Market value is the amount that a buyer would pay to purchase your home and the related land in its current condition. This value is impacted by factors such as location, schools, and crime. Whereas, replacement cost is essentially the amount it would take to rebuild your home from scratch. This figure includes factors like similar materials and the same degree of craftsmanship. But there are non-material costs to consider as well, such as labor, permits, fees, contractor overhead and profit, and debris removal. As a result, a home’s replacement cost often exceeds its market value.

By making sure your home is insured for its replacement cost, you will be getting the coverage you truly need should you ever suffer a total loss.